ABC costing assigns a proportion of overhead costs on the basis of the activities under the presumption that the activities drive the overhead costs. Instead of focusing on the overhead costs incurred by the product unit, these methods focus on assigning the fixed overhead costs to inventory. F Variable costing always treats fixed manufacturing overhead as a period cost. Thus all fixed manufacturing overhead costs are expensed in the period incurred regardless of the level of sales. Using the absorption costing method will increase COGS and thus decrease gross profit per unit produced so companies will have a higher breakeven price on production per unit. The marginal cost will take into account the total cost of production, including both fixed and variable costs.

Accounting Jobs of the Future: How Staffing Agencies Can Help Land Them

This measures the costs that are directly tied to production of goods, such as the costs of raw materials and labor. While COGS can also include fixed costs, such as overhead, it is generally considered a variable cost. With variable costing, companies can determine the breakeven price – the price where total sales revenue equals total variable costs. Knowing this helps set competitive pricing while still covering variable expenses. Variable costing, also known as direct costing, is an accounting method that separates fixed and variable costs.

What Comprises Marginal Profit?

Whereas, full costing, also known as absorption costing, is mainly for external reports. JDN, a phone case manufacturer, shared parts of its income statement for 2024. In 2024, the company produced 1,000,000 phone cases with total manufacturing costs of ₱33,700,000 (around ₱33.70 per phone case).

Variable Costing vs Absorption Costing: A Comparative Analysis

It can result in higher inventory values and profits when production exceeds sales. Variable costing provides a more accurate picture of your cash flow, which is critical for small manufacturers operating with tighter margins. In the previous example, imagine you manufactured 5,000 items but sold only 4,000, at $20 apiece.

- But it does not assign all manufacturing costs to products, so it does not represent the full cost like absorption costing does.

- Variable cost and average variable cost may not always be equal due to price increases or pricing discounts.

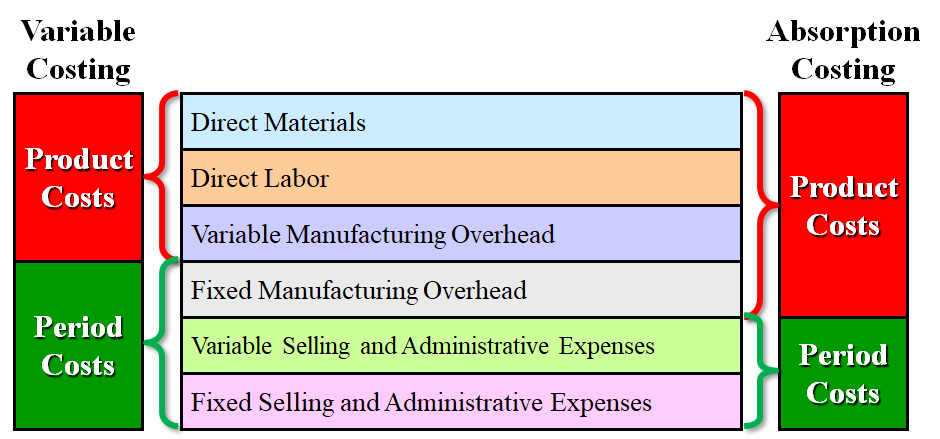

- Variable costing only includes the product costs that vary with output, which typically include direct material, direct labor, and variable manufacturing overhead.

- Carrying over inventories and overhead costs is reflected in the ending inventory balances at the end of the production period, which become the beginning inventory balances at the start of the next period.

- Though this does mean that the reported gross margin is higher, it does not mean that net profits are higher – the overhead is charged to expense lower in the income statement instead.

Managing Variable Costs for Profitability

With high operating leverage, small gains in revenue lead to large gains in operating profit. Variable costing quantifies operating leverage, helping managers evaluate risk vs. reward. As the company’s cost accountant, the manager wants you to decide whether or not to accept this order.

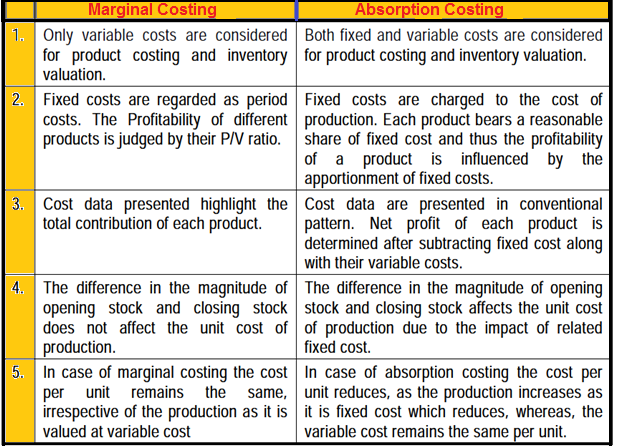

Variable costing or Direct costing is a costing method that includes only variable manufacturing costs — direct materials, direct labor, and variable manufacturing overhead in the cost of a unit of product. Advocates of absorption costing argue that fixed manufacturing overhead costs are essential to the production process and are an actual cost of the product. They further argue that costs should be categorized by function rather than by behavior, and these costs must be included as a product cost regardless of whether the cost is fixed or variable. Variable costing provides managers with the information necessary to prepare a contribution margin income statement, which leads to more effective cost-volume-profit (CVP) analysis. By separating variable and fixed costs, managers are able to determine contribution margin ratios, break-even points, and target profit points, and to perform sensitivity analysis. The only difference between absorption costing and variable costing is in the treatment of fixed manufacturing overhead.

Recently, they received a special order for 1,000,000 phone cases at a total cost of ₱22,500,000. Absorption costing is not as well understood as variable costing because of its financial statement limitations. But understanding how it can help management make decisions is very important. See the Strategic CFO forum on Absorption Cost Accounting that helps managers understand its uses to learn more.

Absorption costing allocates a portion of fixed manufacturing overhead costs to each unit produced, based on the normal capacity for the period. This means that more fixed costs are included in the inventory valuation on the balance sheet. The result is higher net income during periods of production growth and lower net income etf vs mutual fund when production declines. Carrying over inventories and overhead costs is reflected in the ending inventory balances at the end of the production period, which become the beginning inventory balances at the start of the next period. It is anticipated that the units that were carried over will be sold in the next period.

Meanwhile, fixed costs must still be paid even if production slows down significantly. A high operating leverage indicates that a company has a larger portion of fixed costs compared to variable costs, making it more sensitive to changes in sales. As sales increase, the company can generate a higher profit margin due to the reduced impact of variable costs on total expenses. Conversely, a decrease in sales, without adequately reducing fixed costs, can lead to a significant decline in profits. It’s important to differentiate variable costs from fixed costs, as they have different impacts on a business’s financial health and decision-making processes. Fixed costs are expenses that remain constant, regardless of changes in production or sales volume.